secu car loan credit score

Schlumberger Employees Credit Union offers convenient auto loan financing to members residing in the US. According to a 2017 report from VantageScore Solutions and financial consulting firm Oliver Wyman auto lenders used a VantageScore credit score for more than 70 of new auto loan and lease decisions from July 2016 to June 2017.

There is no minimum credit score requirement for receiving an auto loan through SECU every member is eligible for the same loan APR regardless of score.

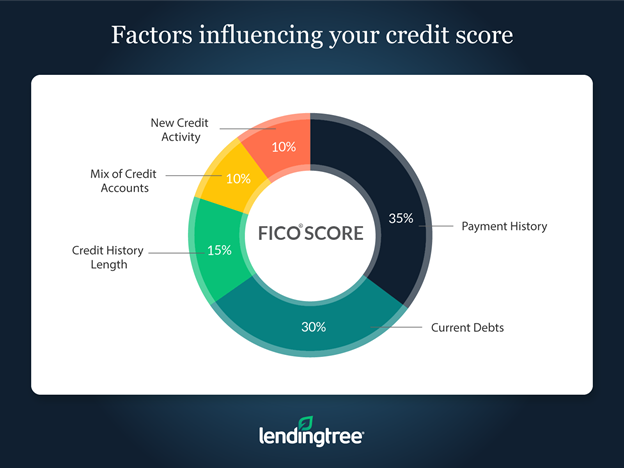

. Box 6541 greenwood village co 80155. While theres no universal minimum credit score required for a car loan your scores can significantly affect your ability to. FICO also provides credit scoring models that are specific to the auto industry giving lenders more specific information on your likelihood of paying back a car loan on time.

And drive home happy with a secu auto loan. Take the time you need and keep your monthly payments low with our flexible terms including financing for up to 84 months for well qualified buyers. With an stcu auto loan youll get on the road with great.

Compare Apply Today. Advertised rates are subject to change without notice and are subject to credit approval. As a member of the Credit Union you are eligible for the SECU Fast Auto Loan service.

Our advanced technology allows for electronic delivery and closing regardless of delivery channel. We have low fixed rates with terms of up to six years and down payments are manageable. FICO Auto Scores.

As a member of the Credit Union you are eligible for the SECU Fast Auto Loan service. In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the Q2 2020 Experian. We work fast getting you approved quickly or can get you pre-approved.

Whether you are shopping for a new or a used vehicle weve got the loan for you. We offer loans for both new and used cars with up to 100 of the value. May 5 2021 shawanvalleybirding.

All the perks of financing your auto loan with SECU. Refinance Your Current Auto Loan with SECU and Save Big. You could get approved in minutes.

The woman I spoke with says they dont look at the score but rather the whole account. Check out the many benefits of this new service below. The SECU Fast Auto Loan experience includes faster.

The State Employees Credit Union motto is People Helping People and we operate with the working principle of Do the Right Thing. Save time at the dealership apply today. All the perks of refinancing your auto loan with secu.

CSE Credit Union offers highly competitive rates on all of our auto loans. Well finance up to 125 of the selling price including Tax Title Warranty and Conveyance Fees. Has anyone out there gotten an auto loan through the State Employees Credit Union in NC or another state.

SECU strives to make the process of obtaining an auto loan as easy as possible. The auto loan rates above reflect the discount for a direct loan payment option from a SECU account. We offer new and used products with a variety of terms to fit all of your needs.

SECU is unable to spell business - much less provide banking services for one. If a lender uses this score during the underwriting process any past payment issues youve had with auto loans could make it more difficult to get. SECUs Current Refinance Specials.

Ad Advertised Rate for Excellent Credit. SECUs Current Refinance Specials. Advertised rates are subject to change without notice and.

Additional terms and restrictions may apply. Scheduling automatic loan payments from your stcu accounts is the easiest way to maintain a perfect credit score by always making your payments on time. Account setup was relatively painless.

State employees credit union attn. New auto or truck refinance is for vehicles that are less than 12 months old and registered to the original owner. Im curious about whether I should apply for the loan or my wife should.

Fast online application with electronic document delivery and closing. If your credit score qualifies you for one of our lower posted rates well reduce you to your qualifying rate. In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the Q2 2020 Experian State of the.

The woman I spoke with says they - 5295064. Ad Read Expert Reviews Compare Your Car Financing Options. 2 off for up to 48-months 15 off for 49-60 months 1 off for 61-84 months but not to exceed remaining loan term floor rate is 299 APR must provide proof statement with competitor rate and members must qualify.

Purchase your car with no down payment. Offer not available to current SECU Auto Loans. SECU auto loan question.

State Employees Credit Union is a Federally Insured State Chartered Credit Union with 241 branches assets of 24776228627 that is headquartered in Raleigh NC. Learn about Rate Beat Loan Experience Guarantee. Unfortunately SECU changed the rules in the middle of the game and what should have been a no-cost account turned into a 10-20 a month cost.

Drive home happy with competitive rates as low as 199 APR saving you money over the life of your loan. While theres no universal minimum credit score required for a car loan your scores can significantly affect your ability to get approved for a loan and the loan terms. State Employees Credit Union.

Secu Education Understanding Your Credit

Visit Greater Central Texas Federal Credit Union To Open A Savings Account The Members Of The Credit Union A Savings Account Credit Union Money Market Account

Why Doesn T My Auto Loan Show Up On My Credit Report Experian

Secu Names Michael Lord Ceo Credit Union Oak Tree Skyscraper

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

:max_bytes(150000):strip_icc()/what-difference-between-state-and-federally-chartered-credit-union_final-6d23ae652fc34b3d96a7ce26e31b4543.png)

State Vs Federally Chartered Credit Unions

7 Reasons Why Your Personal Loan Was Declined And How To Fix It

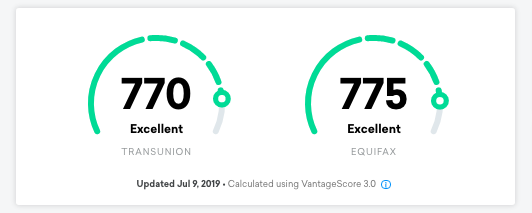

How Accurate Is Credit Karma We Tested It Lendedu

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

How Accurate Is Credit Karma We Tested It Lendedu

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Money Saving Strategies

How To Raise Your Credit Score By 100 Points In 45 Days

/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

3 Doubts You Should Clarify About Texas Credit Union Texas Credit Union Credit Union Good Credit Credit Card Companies